Who let the bulls out?

Bullish revival in EU gas market leaves everyone scratching their heads | EU LNG Chart Deck: 28 October 2024

European natural gas prices are breaking out in another bout of bullish fervour, and everyone wants to know why. The fact that nobody does should tell you everything you need to know about this market: it is irrational.

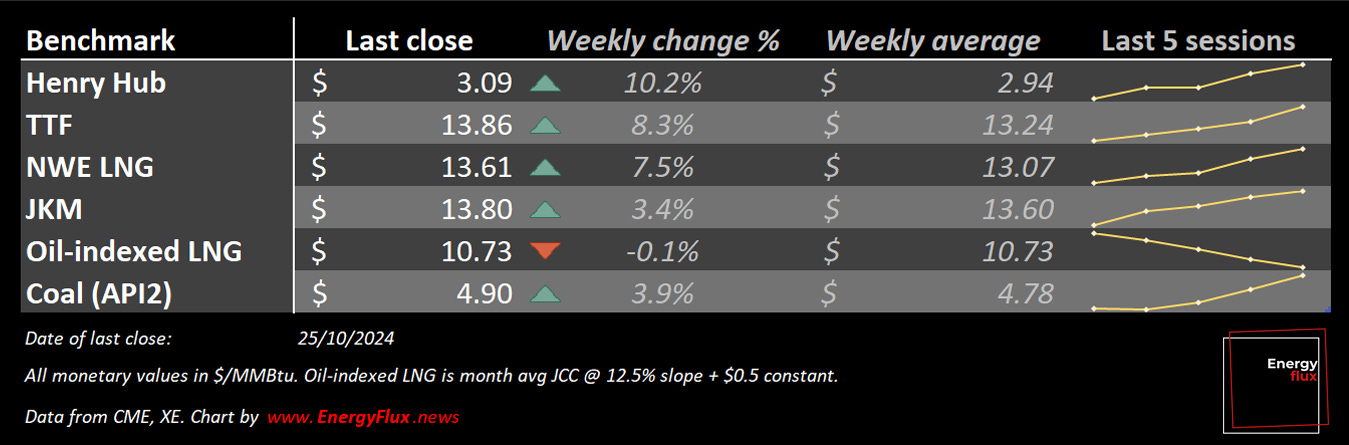

Front-month TTF, the EU gas benchmark contract, surged above the €43 per MWh threshold during intraday trading on Friday, before closing the session at €43.50/MWh: up 11% week-on-week, and a year-to-date high.

The excursion left everyone scratching their heads. An exotic menagerie of ‘reasons’ was promptly trotted out to rationalise this latest episode of capricious price inflation.

This EU LNG Chart Deck dismantles a few pertinent theories about why European gas prices are rallying into what is — still — a fundamentally bearish market. It then takes stock of how the latest price action alters the winter outlook.

I’m delighted to be partnering with two major LNG trade, freight and cargo data providers to enrich my coverage of EU gas markets. Spot the big names in the datavis credits below 🧐

ARTICLE STATS: 2,300 words, 11-min reading time, 14 charts and graphs